For example, if you mistakenly debited too much cash on a transaction by $1000 instead of $500, then credit cash by $500 and debit another appropriate account (such as accounts payable) by $500. Once you’ve identified the account(s), determine whether it requires an increase or decrease in value. For example, if there was a purchase made on credit with terms of net 30 days, then you would need to accrue for the amount owed by creating an adjusting entry for accounts payable.

- You may also want to consider using a software program or online tool to help you track your purchases.

- On May 21, we paid with cash so we do not have credit terms since it has been paid.

- If the purchase is on credit, credit the Accounts Payable account to increase the company’s liabilities, indicating that the company has an obligation to pay the supplier in the future.

- After the debits are entered, you should fill out the credits, which should be equal to the debits, to ensure accuracy.

- Therefore, the amount column represents a credit to accounts payable and a debit to purchases at the full invoice price.

- The process of creating journal entries in accounting can seem complicated if you’re not sure what they’re supposed to look like.

Example of Purchase Credit Journal Entry

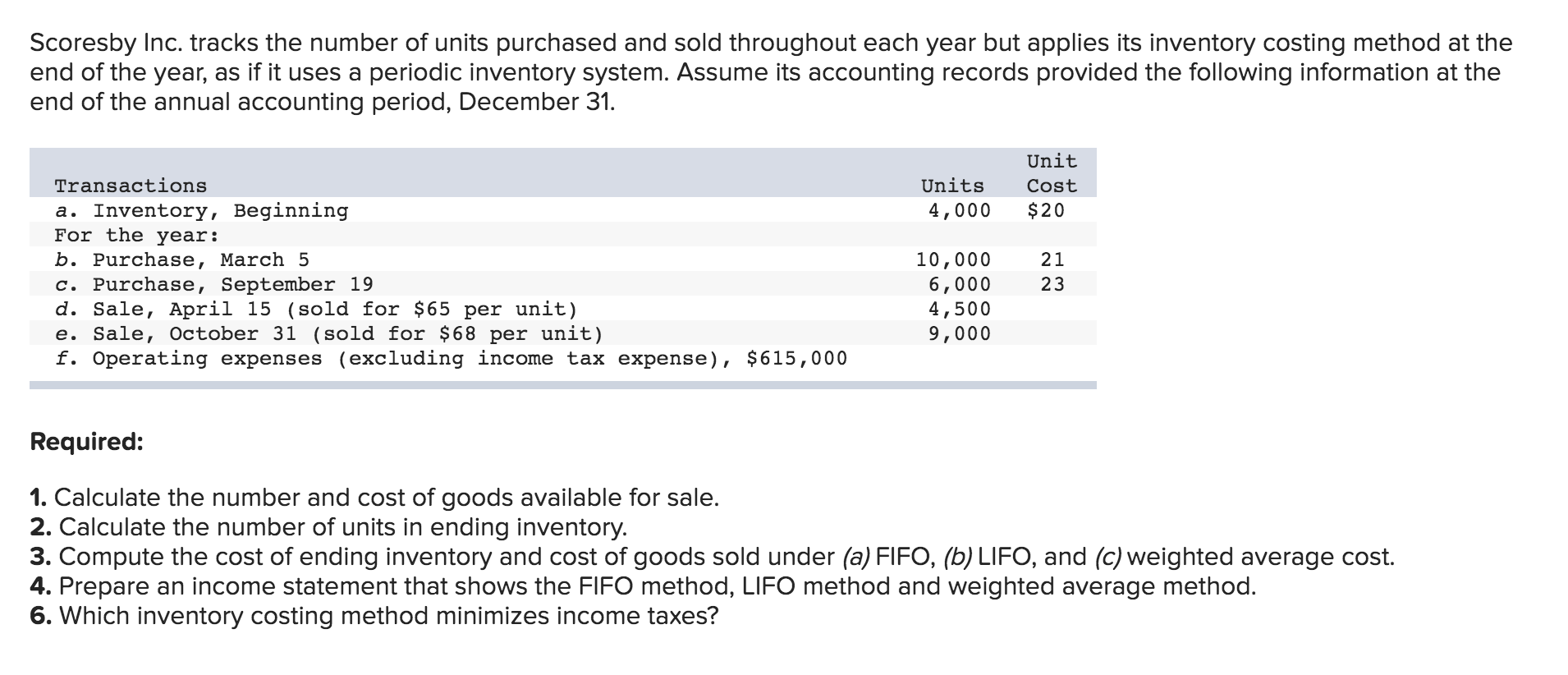

We learned shipping terms tells you who is responsible for paying for shipping. FOB Destination means the seller is responsible for paying shipping and the Bookstime buyer would not need to pay or record anything for shipping. FOB Shipping Point means the buyer is responsible for shipping and must pay and record for shipping. The following video summarizes how to journalize purchases under the perpetual inventory system.

Typical Purchase Transaction Journal Entries

For example, you receive a refund for returning a purchase or adjusting an expense amount. At the end of the month, the amount column in the journal is totaled, and this amount is posted as a debit in the general ledger purchases account. It is also posted petty cash as a credit in the general ledger accounts payable account. Though it may seem daunting at first, with some practice and attention to detail, anyone can master purchase accounting journal entries.

The Reality of Implementing AI in Record-to-Report

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Q4. In which journal is a credit purchase recorded?

To start, identify the asset or expense account that will be affected by the purchase. Both parties agree to a price that the purchaser pays in consideration of goods or services. This purchase price is the transaction amount for all purchase journals. The person or organization from whom the purchase is made is called the supplier, and when the purchase is on credit, the supplier will appear as Creditors on the balance sheet till the time payment is made.

The accurate recording of inventory purchases is fundamental to effective inventory management and financial reporting. On May 21, we paid with cash so we do not have credit terms since it has been paid. As long as you keep these best practices in mind, you’ll be well on your way toward creating journal transactions that simplify the rest of your accounting efforts. If you’re not sure where to start, you can access professional guidance and advice through QuickBooks Live. Experts will guide you through the process and give you real-time advice.

Upon furniture purchase, the value of an asset is increased and according to the Rules of Debit and Credit, an increase in an asset A/c is debited . When recording your correcting entry, note why it was made and when it was made. This documentation can help prevent similar mistakes from occurring again. A cash purchase of inventory results in a decrease in the Cash purchase journal entry account, impacting the cash flow statement by reducing the cash available for operations and other activities.

- This increases liabilities, indicating an obligation to pay the supplier in the future.

- Ensure that you use opposite signs when making correcting entries so that they offset each other.

- A journal entry for a credit is recorded when a company purchases raw materials or goods from a vendor on credit.

- Sometimes, the entity also includes other information related to purchasing like fixed assets, inventories, or expenses.

- The company can also review and verify the inventory on October 12, 2020, by comparing the inventory in the account record with the physical inventory count.

- For example, if there was a purchase made on credit with terms of net 30 days, then you would need to accrue for the amount owed by creating an adjusting entry for accounts payable.

Economics Class 11 Notes

In this journal entry, the purchase of $5,000 does not add to the inventory balance but it will be used in the cost of goods sold calculation. The inventory balances will be based only on the physical count of inventory at the end of the period. Hence, unlike in the perpetual system, the company cannot check how much balances the inventory has immediately after adding the $5,000 of purchase on October 12, 2020. In each case the purchase transaction entries show the debit and credit account together with a brief narrative. The purchase transaction journal entries below act as a quick reference, and set out the most commonly encountered situations when dealing with the double entry posting of purchase transactions. Accounting journals are a great way to break down income and spending into more manageable categories.